SUMMARY

Groww’s plans to become an all-in-one fintech platform became much clearer in 2023 as the company pressed ahead on the lending business and also ventured into payments

Cofounder Harsh Jain says that Groww thinks like a D2C company and looks at problems from a consumer-first perspective to build differentiated products around a strong content moat

Armed with NBFC and AMC licences, the fintech unicorn claims it has deeply understood the problems that consumers face today —- will this be its trump card against rival fintech platforms?

The year was 2017 and four Flipkart executives decided it was time to disrupt the investment tech market. But Lalit Keshre, Harsh Jain, Neeraj Singh and Ishan Bansal had a different view of fintech than most entrepreneurs who jump into this sector. The result was mutual funds distribution platform Groww, where the consumer-first mindset is still paying off.

“We come at problems from a consumer lens because that’s what we know best. Solving problems that customers and consumers face has been our biggest learning at Flipkart,” Jain tells Inc42 at Groww’s HQ in Bengaluru, where nearly 40% of all Indian unicorns have their bases.

But unlike many of its neighbours, Groww has had an optimistic 2023. Jain seems nonplussed when I ask him what it feels like to finally turn profitable as a group. As per him, profits are a byproduct of Groww’s approach to solving the problem.

“We haven’t done anything different, and profitability is just one of our goals. In fact we never had this as a target in our mind that next year we will be profitable. Because we trust that the process of being consumer-first will pay off,” he says, reiterating Groww’s focus on solving consumer problems, which has brought in the results as far as profits are concerned.

Beyond profits, Groww reached another landmark with 6.63 Mn active investors at the end of September 2023, as against Zerodha’s 6.48 Mn. This made the company the biggest discount brokerage by clients in India. For context, Groww had 5.3 Mn active investors at the end of 2022, compared to Zerodha’s 6.3 Mn.

And there’s one more reason why 2023 has been different for Groww — the company’s plans to venture beyond investment tech are becoming clearer and clearer. In other words, Groww too is joining the super app race in some ways, though these are still early days in that regard.

But the blueprint has been laid out — if Groww grew to its current stature on the back of mutual funds and stockbroking, its future could very well be determined by what it took on in 2023.

Firstly, like most other fintech unicorns, Groww jumped onto the lending bandwagon in late 2022, and in 2023, it also entered the tightly contested payments vertical. Effectively, Groww is joining the likes of Paytm, PhonePe, CRED, BharatPe and others in this space, although its lynchpin product remains investment tech.

But as Jain is keen to point out, the approach will be consumer-first. We wanted to understand what that meant for Groww and how the company has leveraged this direction to outgrow long-time competitor Zerodha in some ways.

Our visit to Groww’s headquarters was a part of Inc42’s 2023 In Review series, and we wanted to dive into the fintech unicorn’s journey in 2023 as it prepares for a brave new leg in 2024 with a slew of new products. Here’s what we learnt:

Groww’s Content Stack

At one point during our conversation with executives, Groww is often referred to as a D2C company. The direct-to-consumer model is more commonly used with ecommerce, but even there, the model has become diluted through multiple channels and distribution points.

But in the case of Groww, the approach extends to how the company thinks about new products and verticals.

Another senior executive at Groww tells us that the company’s key strength has been able to convince even on-the-fence customers that investing is not rocket science. The content-to-commerce chain is something D2C brands have tried to leverage for growth. But in the case of Groww, this extends to handholding customers through tough financial decisions via content and allowing them to take charge of their investments in a transparent manner.

The first step is not treating new investors any differently than existing customers except when it comes to content. The end goal for both cohorts of users is the same, Jain reminds us, which is to manage their money better.

Often, discount brokerages get stuck in their positioning around casual or serious investors, and this tends to make it harder for the platform to grow unless the market matures. For Groww, content and its educational initiatives have been the great leveller.

“There’s no such thing as a casual investor. If someone earns INR 15K a month and invests INR 500, they are making a very serious financial decision. So content is critical to help them make the right choice,” the executive mentioned above adds.

Unlike new investors, those who are already familiar with the market and investment strategies need a different degree of assistance from a content POV. There’s also a focus on localisation of content through regional language videos that simplify strategies for new investors.

Localised content is a key pillar for Groww, as we will see, because this ties into the company’s larger plans around lending and other verticals.

Yet, there’s a governance aspect to the content being produced as well, which guards the company against the temptation to bombard new users with content just to drive growth. While many rival investment tech platforms have brought in influencers to bolster content, Groww does it all in-house.

Influencer-led investment marketing has earned a bad reputation in recent months, and Groww does not want to go into this model. On YouTube, it has nearly 2.15 Mn subscribers, compared to Zerodha, which has less than 600,000 followers. Groww launched its YouTube channel in 2017, compared to Zerodha’s 2014 launch.

Instead of relying on other investment experts, Groww prefers a DIY approach when it comes to users Influencer-led investment content has brought trouble for platforms such as Vauld and others in the past, and even market regulator SEBI is cracking down on unauthorised selling.

“We don’t even give our business teams targets to increase transactions, so asking someone like an influencer is out of the question. Again, we wanted to focus on solving for the consumers which influencer-led marketing does not do,” adds cofounder Jain.

Jain believes that not chasing growth has brought the growth that Groww has seen in the past year. “If you do right by the customers, they will stick with you, and eventually each user becomes more profitable. We won’t change this philosophy just for growth.”

In 2021, Groww saw its valuation jump from $250 Mn to $3 Bn+ thanks to massive funding rounds and backing from the likes of Tiger Global, Lone Pine Capital, and many others. The company has since then expanded its lineup of investment tech products, as highlighted above, and added more pieces in 2022-23.

From A Lending Play…

It’s hard to hide from the competition in the fintech space. One way or the other, you will cross paths.

The great fintech convergence is one of the more enduring themes of the past year, as individual apps turned to platforms. Groww is also a platform in many ways, but key leaders in the company believe the difference is in the way it has approached this transition.

Thoughtful product expansion has been the hallmark of CRED in 2023, while massive deployment of capital and resources has been the playbook for PhonePe. Groww has taken customer-first to a different level. And for the company, this is a key USP because it creates a long-term trust bridge between the platform and its users.

“For many days in the past year, our founders have been on the ground and talking to customers directly. We had roadshows to meet some of our most active investors in Tier 2 and Tier 3 towns, where we saw that our customers have deeper problems and a trust in Groww,” says another key member of the Groww platform.

The trust comes from the fact that Groww has helped these individuals see returns on their wealth. Users know that Groww is a legitimate partner and therefore they are more likely to turn to the company for other services.

Based on the feedback from the users on the ground, Groww added lending as the first piece of the platform beyond investments. It had also acquired an NBFC licence through Groww Creditserv Technologies in late 2022 for its first real attempt into lending, and by mid-2023, it had also ventured into UPI payments.

…To Joining The UPI Race

Let’s get one thing clear — UPI is not exactly a novel product by any means and can be expensive to maintain at scale despite its low revenue contribution given the current zero MDR regime.

Even market leader PhonePe struggles to monetise UPI and has to turn to non-payments revenue for growth. But UPI is a glue in the fintech ecosystem and every app realises that UPI can be a top funnel to gain more users.

Groww ranked 28th among all UPI apps in October 2023, facilitating 5.89 Mn transactions totalling INR 3,354 Cr in value. As such, it has a long way to catch up with PhonePe, Google Pay, Paytm and CRED, which are the top four UPI apps in India.

While other companies spend to drive usage, Groww is looking at UPI as a nice-to-have and not as a core focus area. UPI only adds to the trust element of a platform.

Sources close to the company told Inc42 that Groww is also working on a payments gateway business, which is being used to reconcile transactions made by investors on its app. It’s very likely that the company will offer it to other businesses to recoup the investment towards building this product. But Groww did not comment on the plans to enter the enterprise fintech space.

What Can Groww Count On?

Trust is a fundamental building block for any platform, says a founding partner at a Bengaluru-based early stage VC firm. The partner, who primarily looks at fintech investments, believes that fintech platforms need to become walled gardens and there are various ways in which companies are doing this.

Paytm has the deep brand value, CRED has cutting-edge product and design, PhonePe has the scale — for Groww, this is replaced to some degree by the trust from its customer base.

On the lending side, the company has looked at consumer durable loans at the points of sale as well as merchant loans to begin with, but according to sources close to the leadership, there are plans for home loans, personal loans and other credit products.

But the company’s plans are not just restricted to lending. Reports in the past year indicated that Groww is also looking at a co-branded credit card and there was even some speculation earlier about a tie-up with Federal Bank for a neobanking play. These are very much on the cards as well.

Interestingly, Zerodha, Groww’s chief rival on the investment tech side, is also eyeing a banking licence, as per reports. A banking licence is being considered a critical advantage in the discount broking space for speed of executing transactions. As more and more companies look to automate processes for a quicker turnaround time on transactions, having an in-house bank would be a massive competitive edge.

So Groww’s primary objective with its content stack is to inform — and that was also the objective with meeting people on the ground. It’s not about bringing new users, but building trust and visibility with the brand.

If digital-first new-age brands do it through retail channels, Groww does it with roadshows.

Rethinking Asset Management

Groww’s NBFC licence keeps the door open for a larger banking play in the future, but another critical factor is the new asset management business.

Earlier this year, Groww completed the acquisition of Indiabulls’ AMC licence, a process that began in 2021. For Groww, the AMC licence is critical from a revenue point of view as AMCs typically charge a management fee based on the asset percentage, while brokerages generally charge per trade or offer flat-fee accounts. But for Jain, the opportunity is not about revenue but actually changing the trust equation.

Once again, Groww links the product expansion to consumer-first thinking. The consumer does not want the business to ask for money to solve the problem. The consumer wants to see the value of the brand, and needs to trust the brand to solve the problem.

“There is a lack of trust in the industry because products are not very simple. Customers or new investors need a very simple report. They want to know how to invest. They ask, ‘How do I get the money back? Where is it invested? Is it invested with the right philosophy? Are people taking too much risk or are they very conservative?’ We have the opportunity to create that level of transparency with our AMC and that level of governance,” Jain said.

As per him, Groww’s approach to content and solving the problems faced by consumers easily extends to other categories such as insurance. In other words, it’s not just the AMC space or the investment space that is fraught with bad information.

Sources at Groww talk about insurance as one of these areas and how it has remained a mystery product for certain categories. “Think about life insurance. It is the most critical product for long-term financial planning, but it’s the least understood product and it’s the most mis-sold product. There’s the need to demystify this in the right way and no one is doing that yet,” one source close to the management says.

Groww’s Super App Moment

Once again, content is the answer for Groww because the questions the company is asking itself are the questions that the consumer has. Even if content does not always translate into monetisable users, there’s a strong belief that investment tech, mutual funds or even fintech as a whole is not a winner-take-all market. Growing the base of eventual users only helps the ecosystem.

Groww might be more suitable for one kind of consumer, because it has a deep consumer insight. But there will always be room for other companies, just like a healthy economy has multiple banks competing.

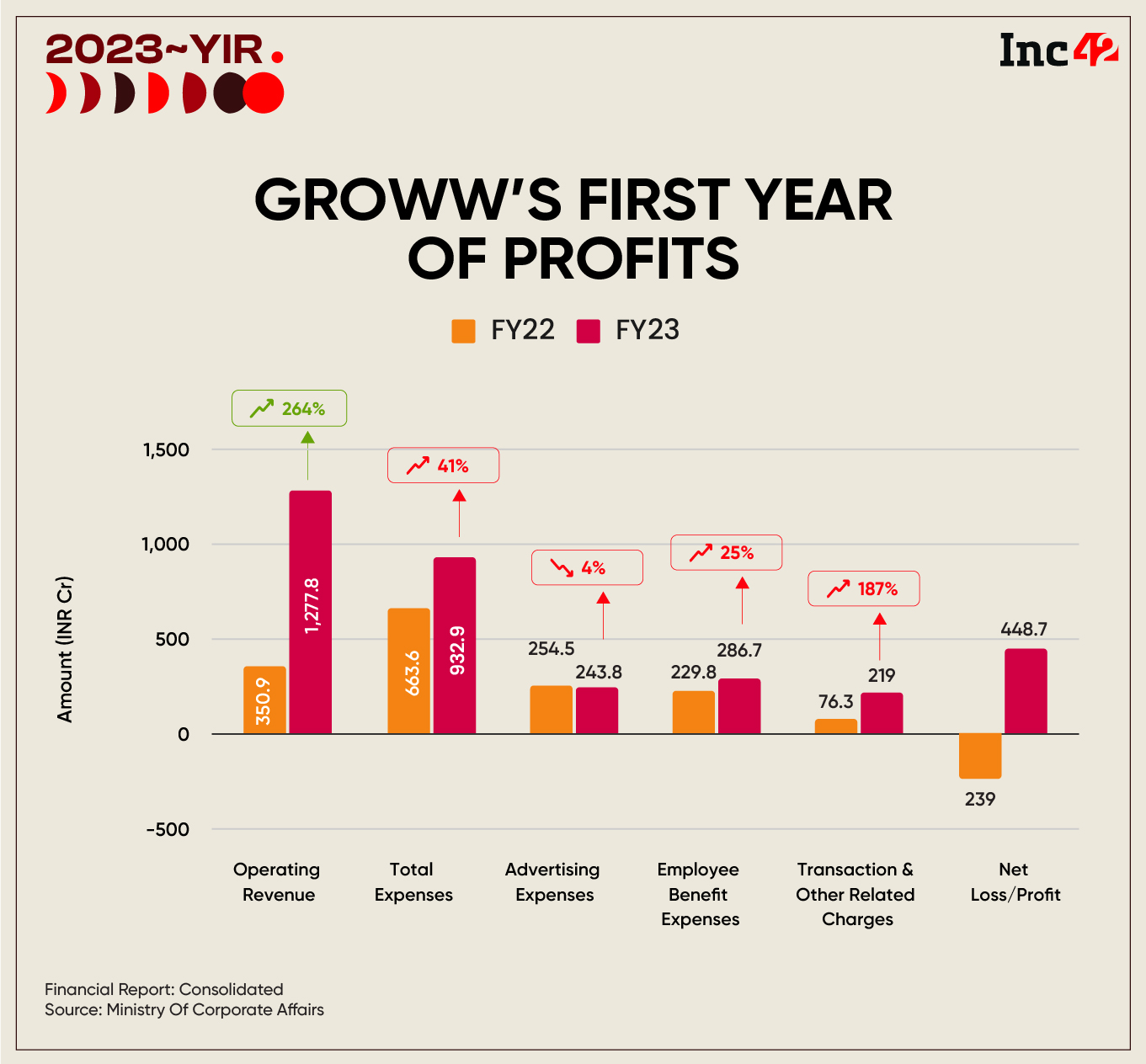

Despite having higher active user numbers, Groww trails Zerodha in terms of revenue. Nithin Kamath-led Zerodha reported INR 6,875 Cr in revenue and a net profit of INR 2,900 Cr in FY23. In contrast, Groww reported a net profit of INR 449 Cr in FY23 on an operating revenue base of INR 1,277 Cr.

The gap is evidently wide, but comparisons with Zerodha are perhaps misrepresentative of Groww’s place in the fintech ecosystem. Or, at least, will be if the company is able to press the accelerator on its larger plans.

Indeed, the comparisons then will be made with the likes of Paytm or PhonePe, and it will be interesting to see where each of these fintech ‘super apps’ stand a year from now. Will their product diversity stand the test of time?

In some ways, Groww has been lucky so far that the company’s products have been well timed with the market growth and the push for investments in India from policymakers. Plus, digital investment platforms grew by leaps and bounds during the Covid pandemic aka one of the biggest bull runs in India.

Even though the past few years have brought in some correction, Groww believes in taking a broader decade-long view. The aspirations of modern Indians are already growing and this is also an important time to help Indians grow in the right manner.

The cofounder believes that just like Groww got ‘lucky’ in the past few years with its core business, it has the good fortune to be building new products for this new India. Incidentally, this is also the best time to prove any thesis around super app platforms as the consumer base is maturing.

And Groww says it knows consumers well — will this be its trump card?